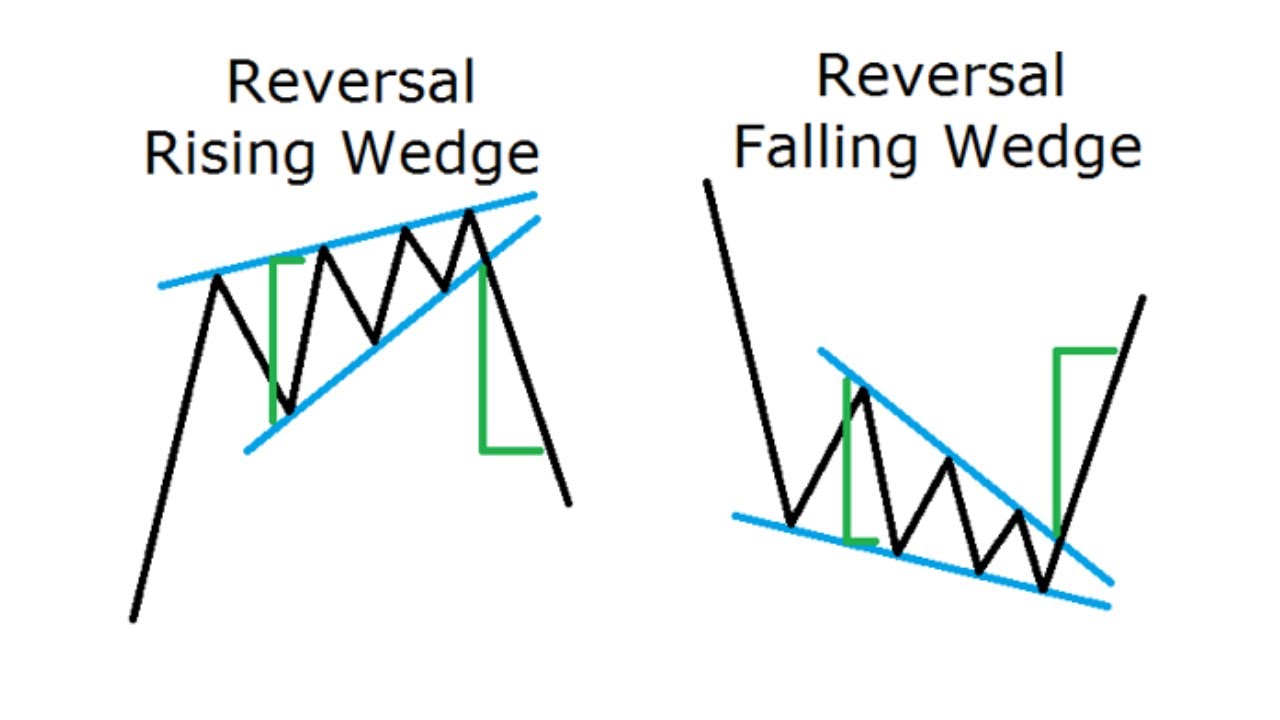

The stop-loss order can be placed right above the rising wedge’s top part to limit losses. This is because the trend indicates a decrease in the prices in the coming forex trading days, and placing a sell order at the top of the wedge minimises losses. The take profit order can be placed at the topmost part of the falling wedge’s trendlines to lock in substantial profits.Īfter identifying a rising wedge, place a shorting order immediately at the trendline’s end to exit the market and lock in profits. The stop-loss order can be placed below the falling wedge’s bottom part to limit losses. Placing a buy/long order here is essential because the trend indicates an increase in the prices in the coming trading days reaping traders significant profits. To trade the falling wedge, place the buy order immediately at the point where the trendline ends to enter the market and benefit from the increasing prices later on. Short the trade at this point to benefit from the falling markets. Identify the existing trend in the market to be an uptrend.Ĭonnect the higher high and higher low price points to get two upward sloping lines that converge during an uptrend.Ĭonfirm the uptrend when the currency pair price moves above the resistance level and finally reverses into a downtrend.

Here is how you can identify the rising wedge pattern in five easy steps – It occurs during rising markets and reverses into falling prices thereafter. The rising or expanding wedge chart pattern indicates a market downtrend reversal. Long the trade at this point to benefit from the rising markets. Identify the existing trend in the market to be a downtrend.Ĭonnect the lower low and lower high price points to get two downward sloping lines that converge during a downtrend.Ĭalculate the divergence between the current trading price of the currency pairs and the trendlines to see how much the market has deviated from the price highs and lows.Ĭonfirm the downtrend when the currency pair price moves below the support level and finally reveres and reverses into an uptrend. Here is how you can identify the falling wedge pattern in five easy steps – It occurs during falling markets and reverses into increasing prices thereafter. The falling or declining wedge pattern indicates a market uptrend reversal. The convergence sends traders a signal of a market reversal during an uptrend, and the prices start to decrease as moreĪnd more traders start shorting their trades and exit the market.

The prices also start to increase as more and more traders enter the market.Ī Rising Wedge Pattern is formed when two trendlines meet due to the continuously rising prices of two currency pairs. The convergence between these two lines sends traders a signal of a market reversal during a downtrend. (A trendline is formed by connecting either two or more highs or two or more lows in a currency pair’s price charts.) Let us understand all about falling and rising wedges in depth.Ī Falling Wedge Pattern is formed when two trendlines meet due to the continuously falling prices of two currency pairs. The wedges alert you against any significant market highs and lows, enabling you to mitigate risks and maximise profits. The Falling and Rising Wedges pattern help identify market reversal signals and accurate market entry and exit points. When you are trading currency pairs in the forex market, it is essential to know when the market can possibly reverse.

0 kommentar(er)

0 kommentar(er)